If you are reading this, you are likely to either be at the dreaded moment where your Business Planning: Taxation (BPT) exam is approaching or you are intrigued about the ACA myth itself. Before you read on, just know that I have been in your position in 2019. It is an unsettling time and initially BPT probably is the most overwhelming ACA exam. That being said I do/did not rate BPT as the hardest ACA exam in the end. I went from 44 in a mock exam (the only one I failed) to achieving 81 in the real exam #notbraggingbutmadeitgreen. I hope this article gives you the confidence you need to pass BPT and I will share what worked for me!

Fun fact: BPT used to be an Advanced Level exam which means you are almost there at this point. Hang in there.

What is the BPT Exam Actually Like?

I have already provided a breakdown of this exam but I will provide a short recap if you need it. BPT stands for Business Planning: Taxation. Yes, a tax exam. Tax Compliance is the exam where you need to perform the tax calculations itself. BPT however has a different angle. There is much more, wider tax content involved and you are instead required to provide tax advice. You are required to talk through taxes rather than performing the calculations itself although a small degree of this could be asked for.

This 2.5 hour open book exam is extremely, extreeeeemely time pressured but the content is quite consistent in terms of the syllabus areas. It will cover taxation of corporate entities, owner managed businesses and personal taxation. However, each syllabus area has so many different possible combinations of tax laws, topics and scenarios that each exam can be completely different. It also requires a vast amount of application but this does not mean you cannot pick up easy marks.

Easy Marks in BPT?!

Before I get into the more complicated areas and risk you feeling overwhelmed, let’s get you feeling positive. As hard as the exam is rumoured to be and can be, BPT does still have some easy marks available!

Mastering the Skill

A big part of the exam is mastering the skill of identifying the relevant tax rule to the scenario in question. Once you can do this, you can really pick up some easy marks here. By stating the basics of the tax rule you spot applies to the question, with a good open book file which we will come to, you will pick up at least a few marks for each. This is why it is important to get through the whole exam. Spending longer getting deeper into a tax concept will hinder your success if it means you are missing the easy initial marks elsewhere.

At this point you may be thinking, “but Jag, how is that easy when you need to master the skill?”. This is a very good point. Try not to roll your eyes when I say this but the only way to master this skill and to get those easy marks is through practise. These marks are only easy if you put in the work. I kid you not, I went through all 60 ICAEW question bank questions in detail. It took me a very long time to master this skill and this happened after the mock but before the exam, hence my drastic mark increase in the real exam.

Note: If you have read my previous blog, you will know I did take some time off before the exam which is why this was achievable for me. Do not get disheartened if you do not have enough time to do this and it is not necessary to pass. Do as much revision and question practise as you can without burning out!

Do not get me wrong, I did not master this skill entirely of course as there is just way too much content and sneakiness in the exam. It does get easier though. When I first started practising, I was probably picking up about 20% of the relevant taxes in the question. I’d read the answer after a rubbish attempt and be shocked at everything I completely missed. Fast forward to the exam stage after all my question practise I would say this was around 75-85%. Remember, there are actually more marks available for the BPT questions than the maximum number of marks (cha-ching). Go easy on yourself, you do not need to know it all!

Ethics

It is not all bad, wishy-washy “just practise” news – I do have some treasure to give you…

Ethics. As an ACA student, you should know by the BPT stage that every exam after Certificate Level will have ethics marks up for grabs. In BPT there are around 5-10% ethics marks. You should aim on maxing out these marks. Ethics is not always simple but you can use your open book to help you on this. Write down all the different ethical scenarios such as tax evasion, avoidance, money laundering and so on. Then match the model answers from the ICAEW question bank to each topic as you go along. You will then have an ethics answer reference guide. All you need to do is ensure you APPLY it to the exam scenario. BPT is all about application.

Approach: Should I Spend a lot of Time Recapping TC and Learning the Content for BPT?

If you can choose, I would advise sitting BPT after TC. It is however possible to sit/pass BPT first (a girl in my class did). Recap the content from tax compliance (TC) if you have sat this exam prior to BPT but you really do not need to go overboard here. As stated above, BPT focuses much more on tax advice rather than the calculations itself. It is good to have a good understanding of how to do the calculations such as income tax, CGT, etc but you do not need to go overboard nailing the calculations and all the little details. You have already proved/will prove you can do this in TC.

Disclaimer: this is my own personal opinion based on how I approached the exam. I have read around 60% of the marks in the BPT exam are for technical matters already tested in the TC exam. This does not mean you need to do perform 60% of the calculations, although there may be a few. It means you need the understanding to advise which is why you arguably do need to recap the content thoroughly before attempting questions.

My approach was to throw myself into BPT question practise and learn/recap from there. This was usually my approach with the majority of ACA exams. It is up to you which method you prefer but if you do throw yourself in, your debriefs of the answers need to be thorough. This enabled me to identify any weak areas. I would then learn/recap the content so I could get better at is as I went along.

I did take my TC question bank in the exam with me as a comfort blanket. I thought I could find a model answer for a calculation I needed to talk through or show a small part of. However, I did not end up finding it and had to move on. Had I followed my own advice, I would have just missed out the extra hard marks to get the easier ones later on. In reality, I actually did not get to answer all aspects of one of the questions and had to miss marks out. Luckily, it was only a few marks in the end so I was fine but I was worried though.

In terms of the new BPT content, I would say it is important to have a decent understanding of the new concepts to begin with. However, remember this is a completely open book exam so do not think you need to nail the content first thing. Your understanding will develop as you come to practise the questions. Again, you can spend time learning the content first but practise is key as so much application is required. That being said, I do know someone who did not do too much question practise but still passed. I would say this is very risky though because of how much BPT is a skills based application exam.

Let’s now get to the good stuff, the open book…

Preparing the Open Book File for BPT

Before I start explaining what worked for me, I should highlight the fact that I am aware that ICAEW materials are now digital. This does make it harder to some extent to have the same approach I will outline below. However, it is still feasible and I will add in pointers to help make this doable.

Preparing an open book can be very overwhelming. Tutors would talk about this amazing open book that would have all the answers but did not really go on to reveal any details for how to go about it. Everyone’s approach can be different and so when it came to it, I honestly had no idea where to start. I can now say that a good starting point would be by trying not to reinvent the wheel.

BPT Summary Notes

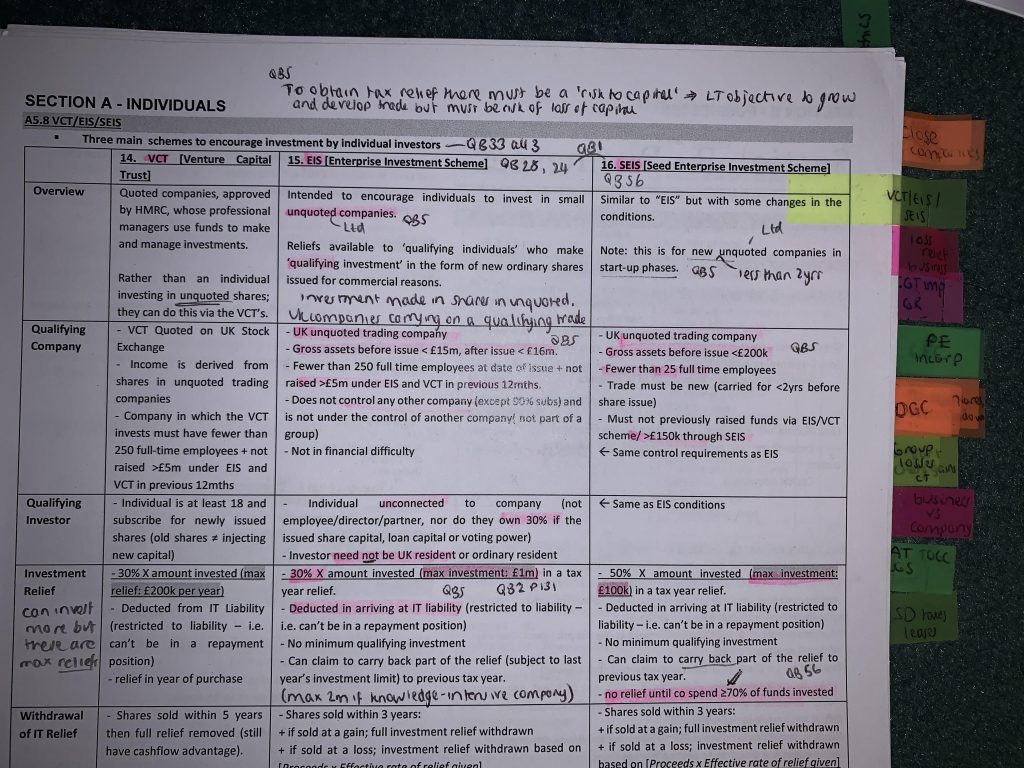

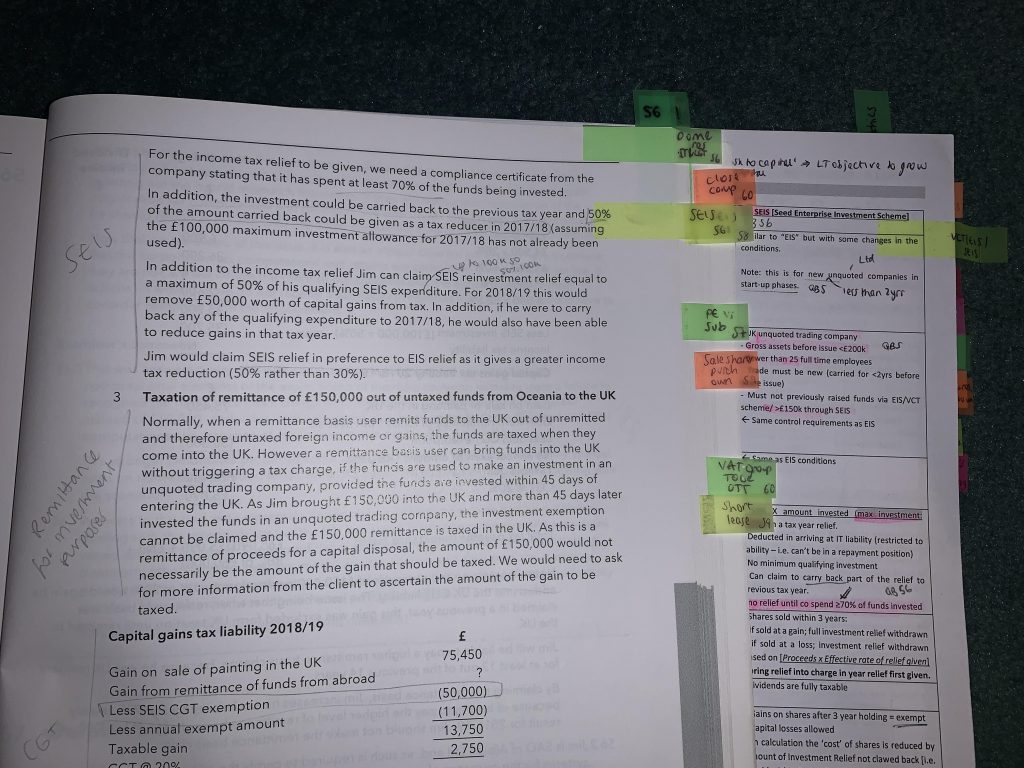

If you are studying with Kaplan/BPP they should provide you with a workbook and summary notes. If not/additionally, ask people at your place of work if they have any good summary notes too as chances are they could do. I did this and these are the notes I used and will show below. Be careful though as tax rules and bands can change from year to year so if you do use other summary notes make sure you update them accordingly. You can also buy these but I do not think this is necessary.

Summary notes are good to use as the basis of the open book file. These would outline the basic knowledge/concepts and then from there you can add key points to it and really build onto it. The building really came along as I did question bank practise and when doing a thorough debrief of the answers. To have a solid open book, you should definitely incorporate the ICAEW BPT Question Bank to know where the marks are.

ICAEW BPT Question Bank

As stated in “5 best ways to Minimise Exam Stress“, I would work backwards from the exam date, plan how many questions I needed to do (60 – leaving some for college) and then pencil these in for specific dates. This worked out to be by practising around one ICAEW Question Bank question a day. In hindsight, what would have worked well is by practising questions with the same key topics on consecutive days. The ICAEW BPT Question Bank should have a contents table at the front to help with this. However, I feel I just planned the questions randomly and it was still fine.

Using my throwing myself in approach, initially with the first 10-15 questions I was really out of my depth. I wouldn’t even actually spend that long attempting the question because I knew I would struggle even with my notes. I would write down the few taxes I could spot that were relevant. This is where having good content knowledge from the onset could help. However, where I really then built up my content knowledge was by spending up to an hour debriefing the model answer. Of course you are never expected to pick up everything but this is where I really started to work on mastering the skill of identifying relevant taxes to the questions.

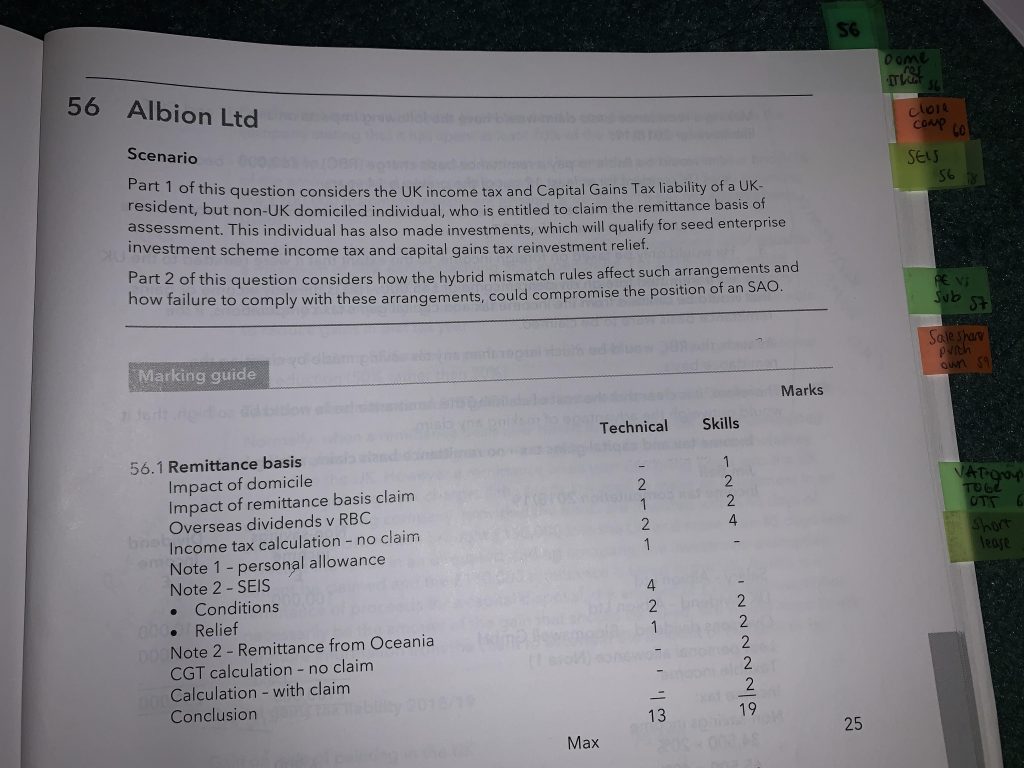

When going through the answer to a practise question, this is where I would start tying answers into my summary notes and building the file. I would find the relevant section in the summary notes and write down the question reference to have it as a good example to look back to. For example, a small “QB56” above the Seed Enterprise Investment Scheme (SEIS) summary notes. I would then also write down any key parts of the answer that are generic and could be applied to other questions such as good introductions or general things to say.

As time went on, as I had started building the open book file up my confidence began to grow. My content knowledge was getting to where it needed to be so I did not need to completely rely on my notes and I was slowly mastering the skill with time. Once you get to this point, and you WILL get to this point, you will find BPT really isn’t THAT bad. This point for me did come quite close to the exam date but I still got there. The real issue with this exam is timing. You should definitely start practising questions to time as early as you can. I will help you with this further below.

Model Answers

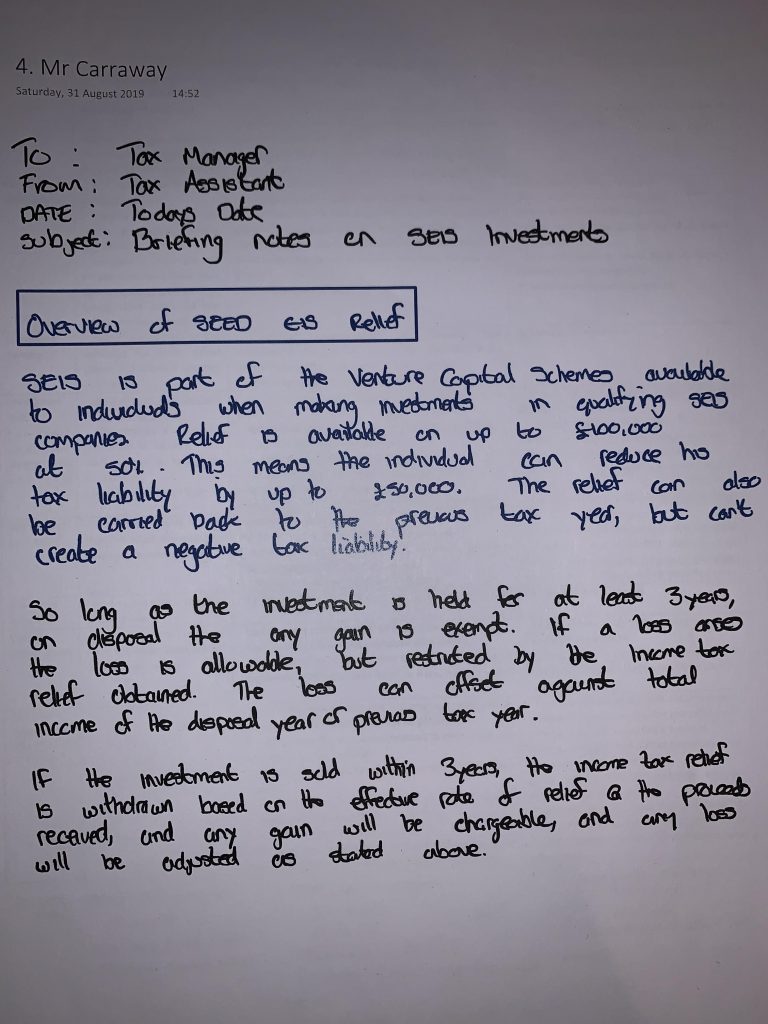

When it came closer to the BPT exam and I had gone through most of the questions (leaving a few unseen for last minute testing), I was now familiar with the most popular topics. I would then write up generic answer sheets for these topics such as residency status, sole trader vs company, etc and have references to the best model answers in the ICAEW Question Bank for these topics too. This meant that if these topics came up in the exam I could start writing straight away but making sure to APPLY THE GENERIC ANSWERS TO THE SCENARIO IN THE EXAM. Application is key in BPT!!

Fortunately for me, I had a great BPT tutor who also sent out model answer sheets for certain topics that would mean I could quickly pick up the easy marks. For example, a ready to go answer for smaller areas such as SEIS. Remember, these marks are only easy if you have mastered the skill to pick these out.

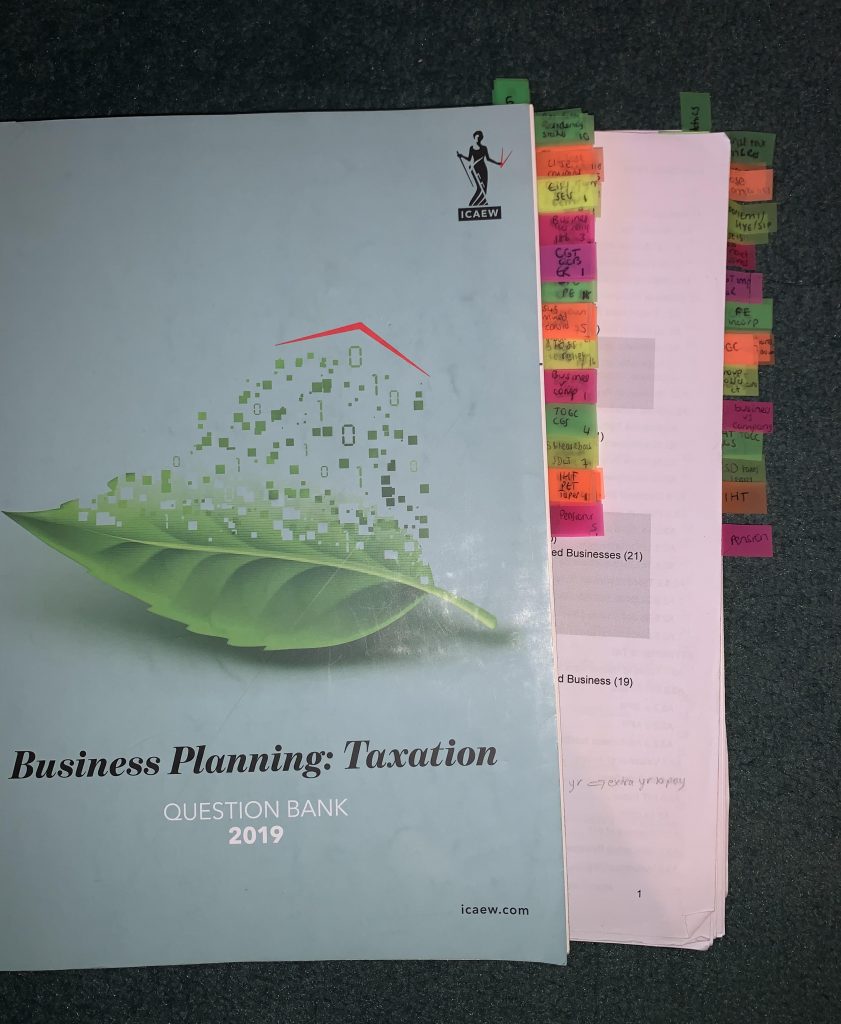

Sticky Tabs and ICAEW Bookshelf

I lived for sticky tabs for this exam! Timing is the biggest struggle with BPT and so to really help cut out time, sticky tabs were key. I would tie the summary notes and the ICAEW Question Bank together with sticky tabs so it was easy to quickly flick to the relevant parts if this came up in the real exam. I did this as I went along because doing this all at the end would have been very long. I know this is where it gets tricky for the Digital Bookshelf as the ICAEW Question Bank is virtual. However, it will still work well for your summary notes.

My approach was to put sticky notes on my summary note pages where I wanted to flag key topics. I did not need to flag everything because with all this practise over time I knew where to look for some. For example, I may not have put a sticky tab for ‘patent box’ but I would know it came straight after ‘IHT’ that was tabbed. I would then use the same colour tab, in the same position along the side for the ICAEW BPT Question Bank answer. On this tab I would write “QB56” for example to flag where the model answer is. I would also annotate on the answer page to make the reference extra clear.

For the digital bookshelf, like I said you can still do this for your summary notes. You will at least be able to access the topics quickly to then find the relevant question online. I do think this could be much more time consuming though.

Here are ways to get around this:

- Use a BPT question reference sheet, as outlined below. The Question Bank will be built into the exam software and students who have used it recently have stated you can search page numbers. Instead of noting down the QB question, write down the page number

- Some students are getting hardcopy ICAEW BPT Question Banks from other students who had them. Although this may work initially, this is perhaps not a good idea as the content, questions and tax rates update. If you do get it early enough to make all the updates needed then this could work well

- Print out the best model answers you think you will need in the exam so you do not have to flick to the ICAEW Bookshelf

- Avoid overreliance on the ICAEW Question Bank for answers to exam questions. Make sure you know which topics it could be very helpful for. Otherwise, have good annotated summary notes, model answer sheets and your brain for the rest!

- Practise makes perfect – start using the ICAEW Bookshelf from very early on (this goes for the ICAEW exam software too) so you are comfortable with it

BPT Question Reference Sheet

As you can tell, I had put in a lot of work to build up my open book file over time. Just because this is what worked for me it does not mean the same approach suits you. You may find you would rather spend more time learning the content initially and start off in a stronger position when first attempting any ICAEW Question Bank questions. It really is up to you how you do this.

I would also like to share another approach I have heard of which seemed to work for others. This is where they would create a table with a list of all the different BPT exam topics. They would then write a reference to the best model answers from the ICAEW Question Bank. In a way this cuts out my step of having to go to the summary notes or to my own model answers first to find the reference. You could actually do both as I did for ethics. It is also likely someone else has produced this reference sheet so ask around and see!

Tax Tables

Another open book you are provided with for this exam is the tax tables for the year of your exam. I will keep this very brief as I did not really use these much. This is because all of the relevant rates and details would have been included in the summary notes. It is better to have all details in one place rather than wasting time flicking between different sheets if you can. I did still take this into the exam with me; I actually took in my tabbed up TC version as I sat both in 2019. However, I did not look at this at all in the exam.

Walkthrough of my Open Book

As stated above, I took the following materials into my BPT exam:

- My annotated and tabbed BPT summary notes

- ICAEW Question Bank also annotated and tabbed

- My model answers including those sheets provided by my BPT tutor

- Kaplan Integrated Workbook just in case

- Tax tables just in case

- TC ICAEW Question Bank (wasted time)

You may be wondering why I have not mentioned the ICAEW BPT Study Manual. I have not mentioned this because I literally did not look at this at all. In all honesty, I can’t say I have used this for any of the ACA exams as it is way too detailed.

To give you a complete picture of what my open book was like, I have included photos below. You can see how the sticky tabs were used. Remember, these summary notes were sent to me by someone at my firm so you will not recognise these.

For those of you who have joined my journey, I will shortly be sending out a few of the model answers I created and took in to hopefully help you give you some inspiration. If you have not yet joined my journey, join now and you can still get these!

NAIL your Timing of the BPT Exam

Hopefully you now have a better idea of how to approach studying for the BPT exam and an idea for how you could put together an open book file. Now we need to come onto an extremely important downfall for students sitting BPT, which is timing. This is said to be the most common reason why students fail this exam. Messing up your timing for this exam really does put you in danger as remember, the easy marks are at the initial parts of the question. You therefore need to get there to get these!

As if BPT isn’t complicated enough, you also have to allocate the marks for the exam yourself. You only get told the total marks for the three BPT exam questions, even though these breakdown into much smaller parts. A good idea would therefore be to plan your timing. Take no more than a couple of minutes to allocate marks between each sub-question. As there are 1.5 minutes per mark in this exam, you can calculate how much time you should be spending on each question. See below:

You will not always get this spot on but practising does help you get better at this. Looking carefully at the wording can help here. “Explain with calculations” is of course going to rack up more marks than “describe”. Additionally, you should know the ethics marks will be a maximum of 10%, usually 7 marks, so do not allocate too much time here.

I cannot stress how important timing is. When I first started this exam, it was as if my hands had froze up and I could not type as quickly as I usually could. Given it was already a time pressured exam, this really was not ideal at all. Therefore, by being strict with timing and moving onto the next question when needed really did help me get through.

Disclaimer

That’s a wrap – I again would like to state that this blog outlines what worked for me. Hopefully this blog has helped give you an insight into the BPT exam, an idea for how to approach the exam as well as preparing the open book file. It is by no means the “right way”.

Additionally, please do not be alarmed or overwhelmed by how much preparation I did. I have always had the mentality that I need to get through every ICAEW Question Bank for most of the ACA exams. This was my attitude for BPT and is what I did. In all honestly, I probably did not need to put in as much work to pass BPT but I aimed to do as well as I could.

Remember, there is a reason most students rank this as the “hardest ACA exam”. Do not be hard on yourself if you do struggle as most students do. If you need any help or further support from other students, feel free to join this ACA LinkedIn group. You can also post your thoughts and comments below.

Good luck!

Hey, so i am sitting BPT with BST in 3weeks time (roughly have 3weeks of leave (study+annual leave from Monday). I am planning on smashing out around 80% of the QB out (that is 80% of the 59 questions on the QB) and do it roughly 3times – so do each questions or alteast attempt to complete each question 3times around (I follow the same advice I was given for certificates level exams where our tutor told us to do the QB for each exam at least twice. I just do it more 1round for my own self-assurance).

As a BPT is such a skill-based exam (so, like not similar to FAR or FM where the format of the question would be pretty similar but you just need to do know the technical knowledge), do you think its better to do 3rounds but only complete around 80% of the paper or try and do every single ques on the QB?

Also for BST, how many question did you actually attempt to complete or would advice any one sitting it with BPT to complete?

Side note: Your blog is very nice to read as the experience you have wrote about is very similar to what i currently experiences. Would love to know/read more of your experience of how you find working at the BIG4 as an AM and before, as a senior (I am going to be a senior at the Big4 in Sept and contemplating on whether its really worth sticking to Audit and move up the chain or switch to something else).

Hi Kamran,

The first thing I would say on this is that doing the QB three times for Professional Level, especially BPT is likely to be more counter-productive. With Certificate Level, this advice is much more appropriate given how short the questions are and how quickly you can get through them. Professional Level exams require much more time to get through each questions. For example, for BPT to get through even a shorter question could still take up to two hours to practice, mark and debrief. You also need to factor in the time to really build on your open book file from this.

I would therefore definitely not advise trying to go through the QB three times for this. This will avoid:

1) burnout

2) ineffectiveness

Getting through the QB for Professional Level, including BPT is enough to do once. As long as you really do take the time to go through the answers and build the skills you need to do well in this exam. As mentioned, you also need to take the time to build in model answers from the QB into your open book file. The issue of repeating questions in BPT is that you may remember what taxes were relevant to the question because you have seen it before rather than actually knowing how to pull out the relevant taxes if it was an unseen question.

In terms of completing the paper, BPT is extremely time pressured. However, the easy marks are at the start of each question as you can get the marks for stating the basics of the relevant taxes you can pick out. I would always recommend for BPT to try to get through the whole paper instead of 80%. This is so rather than wasting time on the harder marks and missing those easier you can pick these all up.

For BST I found I was quite good at based on the progress test and mock exams I sat. I was already achieving 70+ so I felt quite confident for this one. For that reason, I did not do too much extra practice. I will be releasing a blog on this next Thursday but I probably spent one weekend going through and reading up on answers. Where I did practice was with the number analysis type questions as I found I could definitely improve on that and it would be beneficial to the exam.

I will definitely consider writing a blog on this! One thing I will say is that with audit you will continue to learn and grow. It is definitely a great starting point. Assess it each month or year and see where it goes or if you feel you are ready to move on.

All the best!

Thank you for the quick reply and detailed advice – very much appreciated. I guess I will switch my revision plan around to try and complete all the questions on the QB (never done that before but first time for everything) rather than only doing the majority of the ques but 2x/3x. I have actually bought an open book (BPT) notes online (from this site called ACAMasters) – so sorted for that but never thought of putting model answers from the QB into them – so that’s a great little tip!! Thank you again and I look forward to reading your future blogs!

Hi Jag! Thanks for the post. I’m about to retake this exam and I wondered if you had any pointers on know which points are relevant and which aren’t? I sat a marked mocked yesterday and found a lot of the points I was making were not earning any marks. Any tips would be useful! Thanks in advance

Hi Faith,

No worries at all!

BPT can honestly be so difficult to pick out what is relevant and what is not but I really do think it comes with practice.

I think what could help in your situation is perhaps to thoroughly go through the same question again with the mark scheme and see what parts of the question/scenario triggered each part of the answer. It would also help by debriefing the other way to see why your points that gained no marks were not relevant as you may find there could be rules you are missing causing the tax not to be relevant in the given scenario. If you really take the time to go through this hopefully things start to click and fall into place.

As you are perhaps short of time with the exam being next week, I would recommend asking your tutor (assuming you have a training provider) to help explain why. Hopefully it is just small tweaks of knowledge to get you in the right direction.

I would also suggest trying a few new questions and doing answer plans to see if you start to spot key things that come up and help identify relevant taxes although there are so many.

All the best with your exam next week and fingers crossed for you!

Thank you so much for your advice Jag! I kept this in mind as I just sat the exam. Fingers crossed it went well! Thanks once again

No worries at all Faith – I hope the outcome is positive for you 🤞🤞

Thank you Jag for all the tips! This has been very helpful. I am in the process of preparing for BPT, which I am sitting in December. Would you say BPT is more challenging than SBM, CR and Case Study? Just wondering what to expect next year.

No worries and good luck for BPT in December!

If you have seen my difficulty ranking: https://www.youtube.com/watch?v=BpKai9bELj0 I go into some detail about this where I did actually find CR to be more difficult than BPT. CR I found to be the hardest ACA exam and then BPT second. This is because with the BPT content, after a lot of question practice once you grasp the content the main difficulty comes with timing. However, with CR there is SO much content that can actually be very difficult to apply that the exam I felt did really increase in difficulty.

In this video I talk about why I almost failed CR which may be of interest: https://www.youtube.com/watch?v=Gu6bXPKUFGE. I think had my exam not have been so difficult, I would not have felt this way but because of the exam I had, I really did experience how difficult it can be.

I hope this helps!

Hey Jags,

Tried to contact you via email, it would be super helpful if we could organise a chat!

Thanks,

Tej

Hi Tej, I have just emailed you!